Our vision

Financial services,

made easy

Thanks to tech, data and financial products

Our vision

Financial services for retailers, made easy

Retail distribution in Africa, in Cameroon especially relies on slow evolving technology.

Small merchants, formal and informal, are the last mile between large retailers and their customers.

Our goal is to free merchants from time-consuming operations, by giving them access to financial services at their fingertips.

Small merchants, formal and informal, are the last mile between large retailers and their customers.

Our goal is to free merchants from time-consuming operations, by giving them access to financial services at their fingertips.

Large retailer

Small merchant

End customer

Retailers in Cameroon

200 000 Businesses

in Cameroon

800 000 Small

Merchants

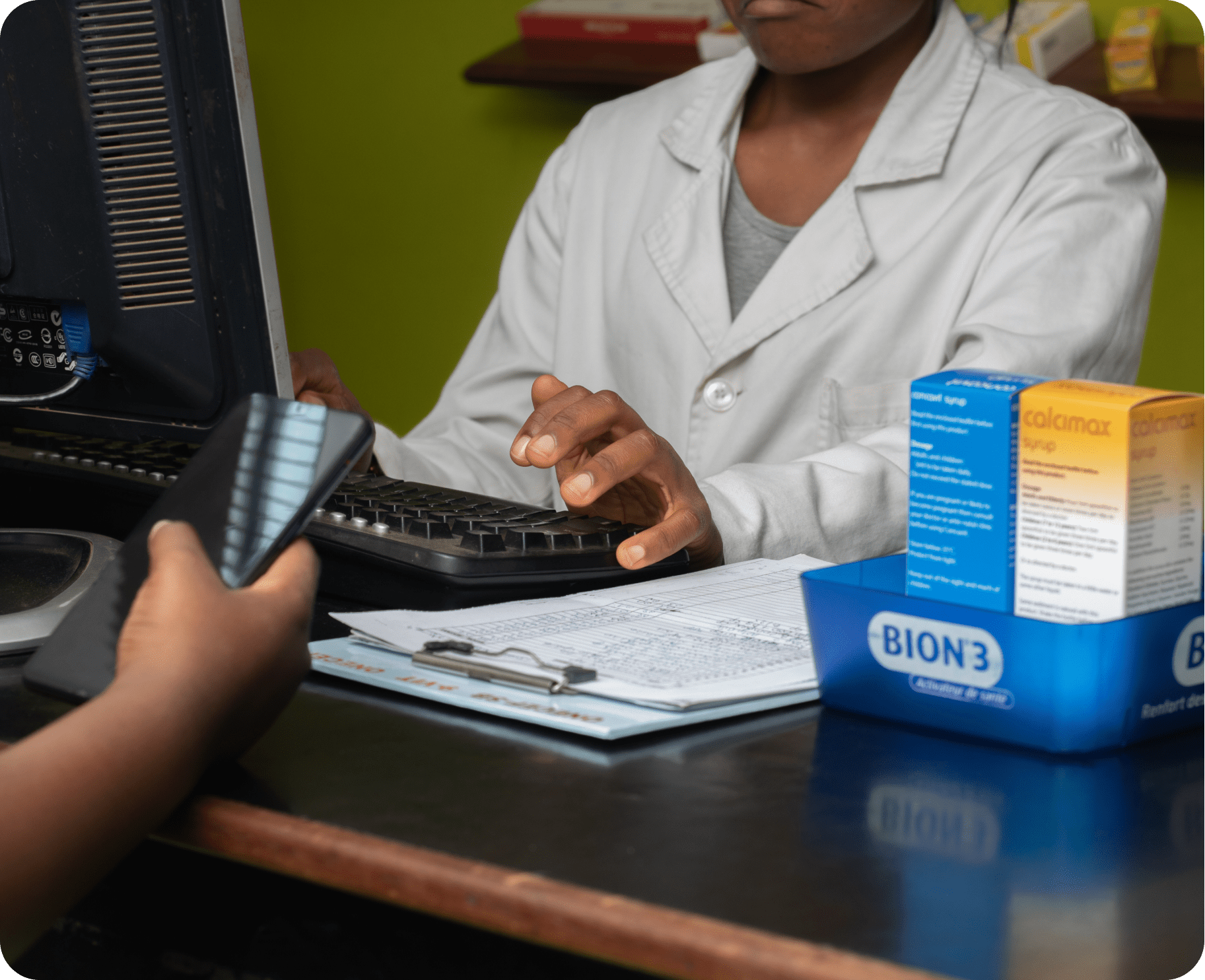

our mission

Merchant payments and financial services

In Africa, small businesses have always been the cornerstone of our socio-economic lives.

In the age of mobile money, this is where we buy things, but also deposit and withdraw funds.

In the age of mobile money, this is where we buy things, but also deposit and withdraw funds.

Our current quest is to provide a single platform, to get paid, pay others and earn money.

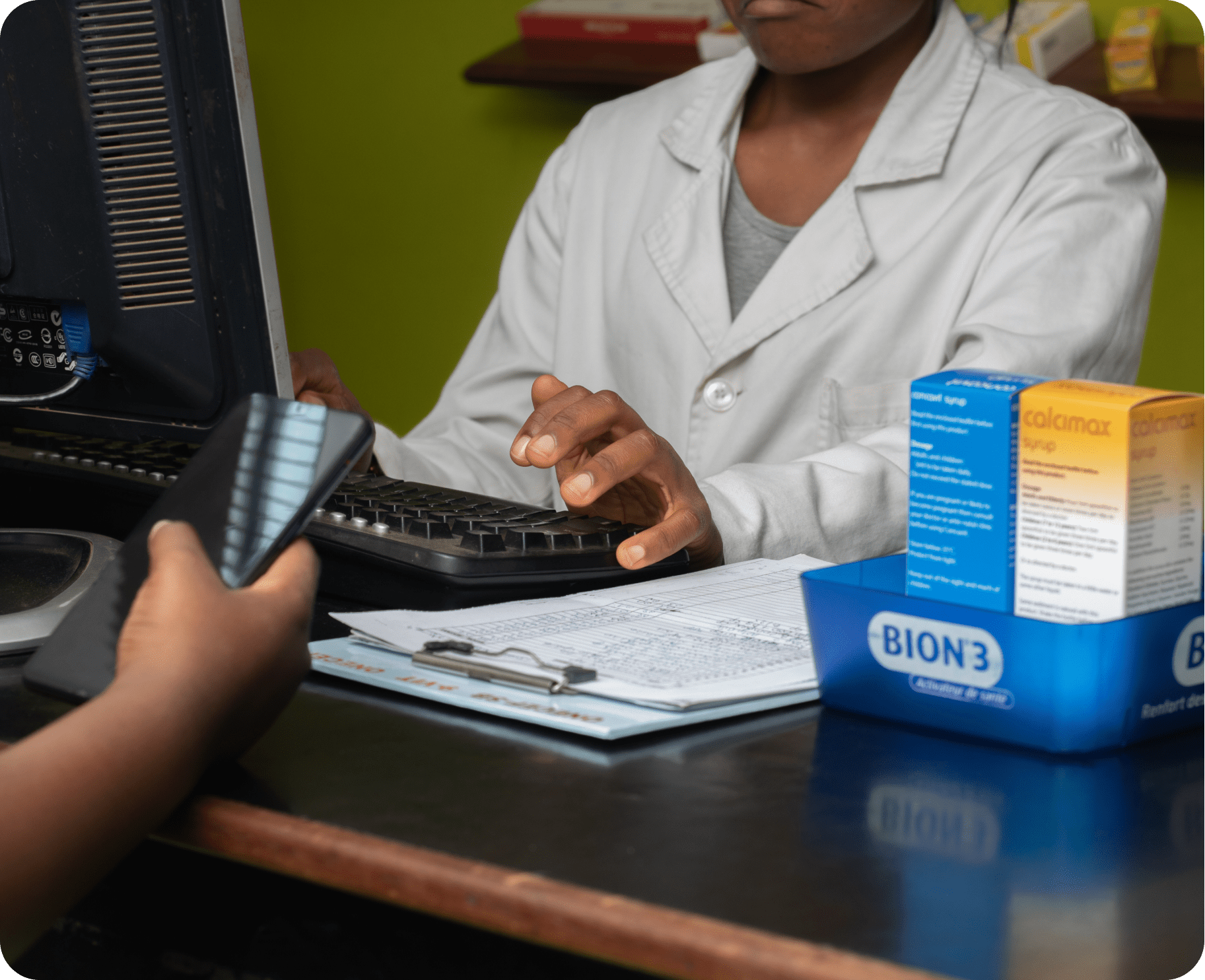

our product

One platform, multiple

functions

Merchants want to serve their customers quickly and accept all means of payment offered.

With the funds received they buy inventory from their suppliers, add value and sell again.

With the funds received they buy inventory from their suppliers, add value and sell again.

With a single platform to conduct their operations, they can save time and operational costs.

our story

Finance & engineering

From banking to the real African economy.

We come from investment banking, legal engineering,

telecom and software. We have experienced payment

barriers, especially for businesses, in our countries of origin.

telecom and software. We have experienced payment

barriers, especially for businesses, in our countries of origin.

We design our product like bankers would, and then we

operate it with technology.

operate it with technology.

our commitment

Reliability, security and trust

Trust is the central feature of all financial activity, no matter where. It is necessary to protect the integrity of the payment system for those who need it most.

We are committed to ensuring that our systems are protected, only authorized users have access and their activity is legal.

diool’s naming story

Diool, synonym of trade

Inspired by the fabulous history of trade in West and Central Africa, Diool takes its name from the Dioula language, spoken in many countries when it comes to buying or selling.

Diool is fast, reliable and 100% secure

Sign up in just a few steps

1

Create

an account

2

Prepare

your documents

3

Fill

the form

4

Sign

electronically

5

Start

after validation*

(*) in a few days after the usual KYC verifications